If you are aged 60 or over, all lump sum super withdrawals will be received tax free. If you are under age 60 (but above your preservation age), the tax-free portion of your lump sum withdrawal will be received tax free. The taxable portion of the withdrawal will also be received tax-free up to the lifetime low rate cap, which is $235,000 for.. For example, a 70-year-old super member with $3.9 million in super and three adult children could use the $900,000 “excess” as a tax-free withdrawal and gift it to children.

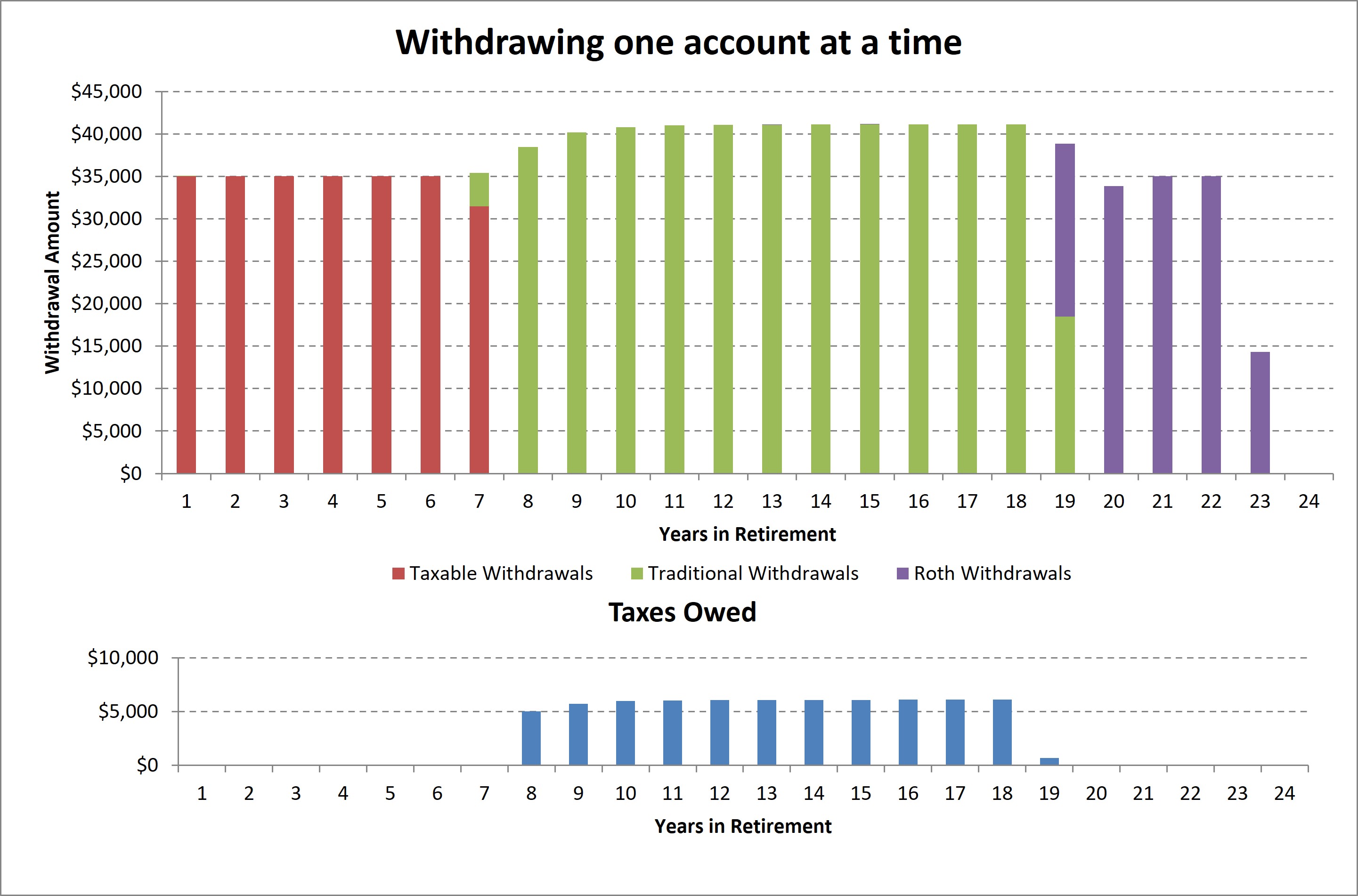

TaxEfficient Retirement Withdrawal Strategy

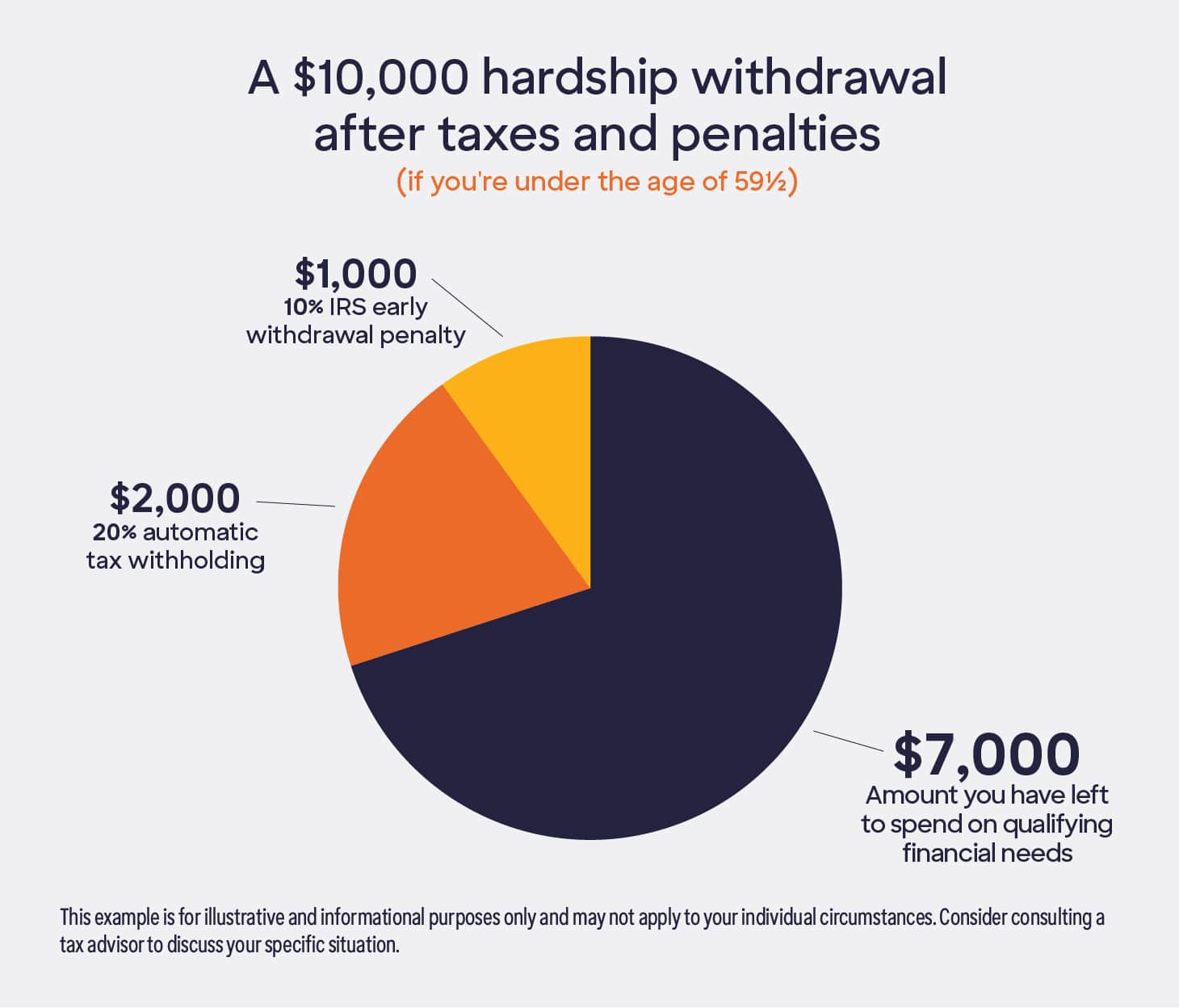

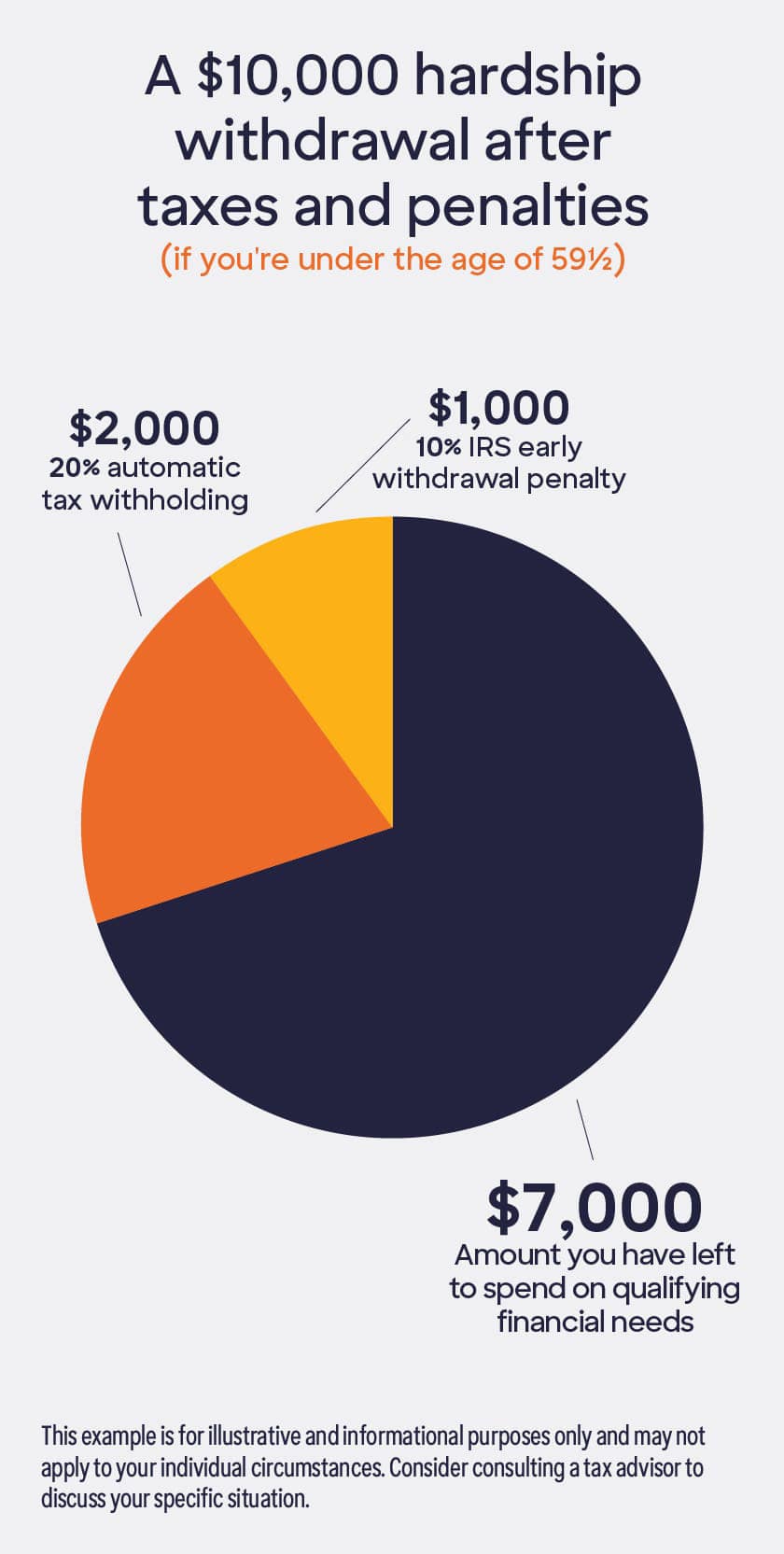

401(k) Hardship Withdrawal What You Need to Know Discover

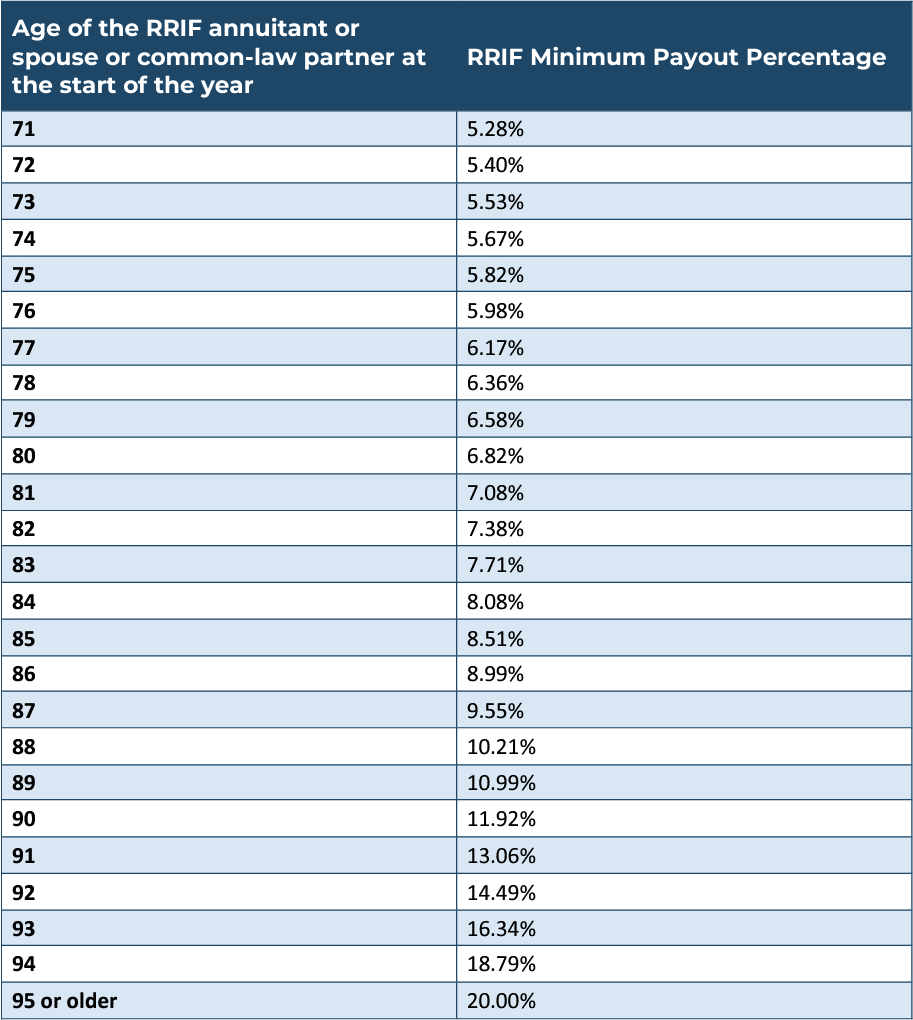

TaxFree RRIF Withdrawals and InKind vs InCash Transfers Early Retirement Affects CPP YouTube

Savvy tax withdrawals Fidelity

401(k) Hardship Withdrawal What You Need to Know Discover

Tax Efficient Retirement Withdrawals DESMO Wealth Advisors, LLC

Huge Cash Withdrawals? Know about Tax Deduction on Cash Withdrawals (Section194N of the

Do You Need to Pay Taxes on Your TSP Withdrawal This Tax Season?

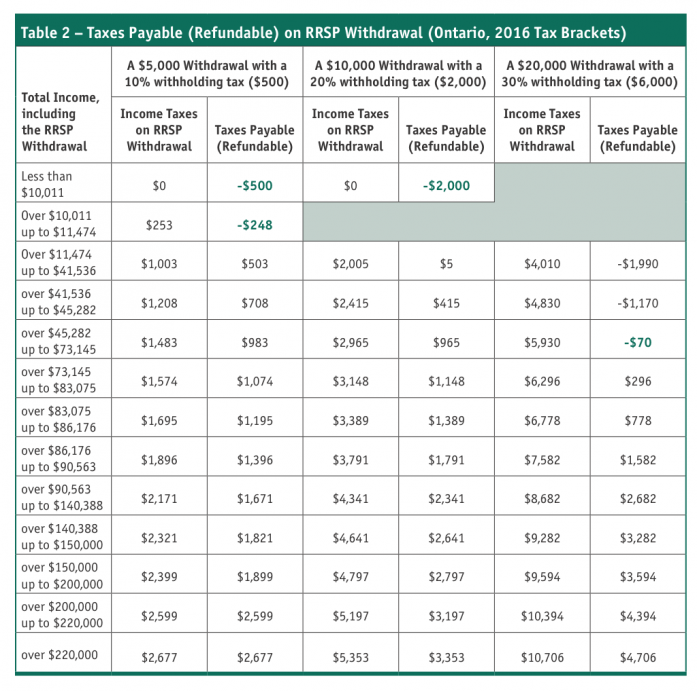

Withholding Tax on RRSP Withdrawals What You Need to Know

Anz Smart Choice Super Withdrawal Form Fill Online, Printable, Fillable, Blank pdfFiller

Are Super Withdrawals Tax Free In Australia One Click Life

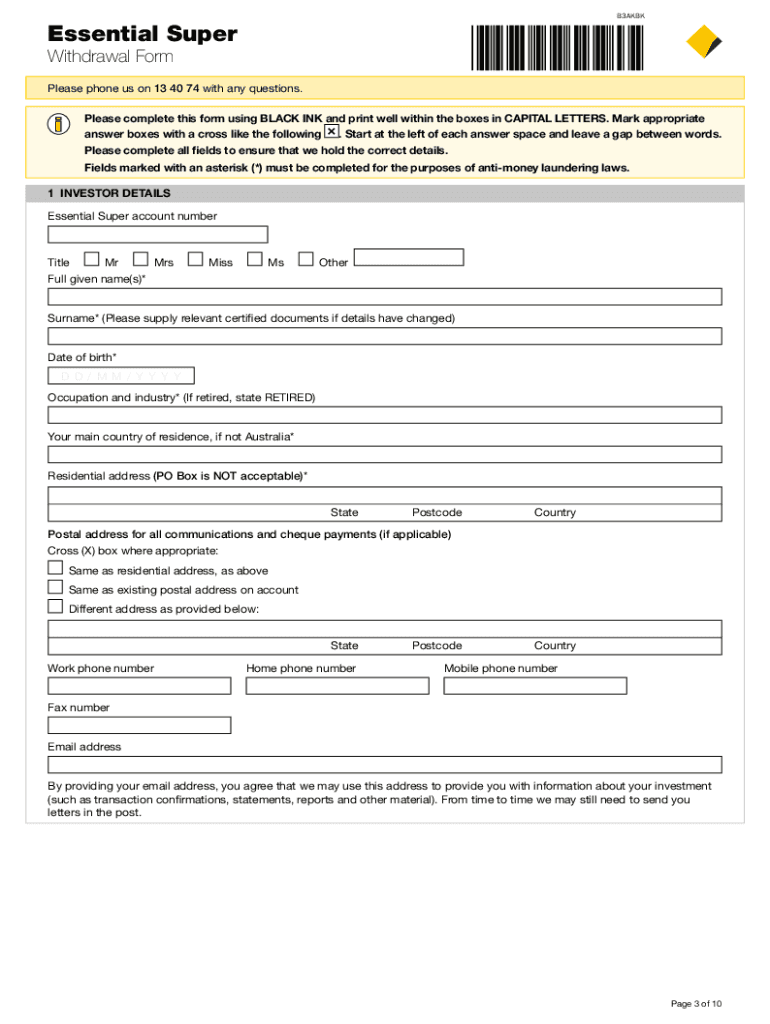

Essential super withdrawal form Fill out & sign online DocHub

How to withdraw your superannuation

Understanding The RRSP Withdrawal Withholding Tax Canadian MoneySaver

Certain IRA Withdrawals Free of Tax Penalty

TaxEfficient Retirement Withdrawal Strategy

Eight Things to Know About RRIFs in 2023 Harvest ETFs

Minimum Super Withdrawal Rules & Superannuation Pension Drawdown Rates

Tax on Superannuation Withdrawals Lump Sum & Pension Payments

Anz Superannuation Withdrawal 20142024 Form Fill Out and Sign Printable PDF Template signNow

Understand super basics. How super is taxed. Super is a great way to save money for your retirement. It is generally taxed at a lower rate than your regular income. You typically pay 15% tax on your super contributions, and your withdrawals are tax-free if you’re 60 or older. The investment earnings on your super are also only taxed at 15%.. The tax on a lump sum super withdrawal of $600,000 when aged 60 or above would be calculated as follows: Tax on Tax-Free portion = $300,000 x 0% = $0. Tax on Taxable portion = $300,000 x 0% = $0. Total Tax on $600,000 Withdrawal = $0. This video explains when you can access your super tax-free.