Fixed-income investing is a lower-risk investment strategy that focuses on generating consistent payments from investments such as bonds, money-market funds and certificates of deposit, or CDs.. Fixed-income investments can provide a steady stream of income through dividends or interest payments. In the investing landscape, fixed-income is generally considered a less risky asset class since there’s some predictability about what you can earn. You may use fixed-income investments to generate current income or retirement income or as.

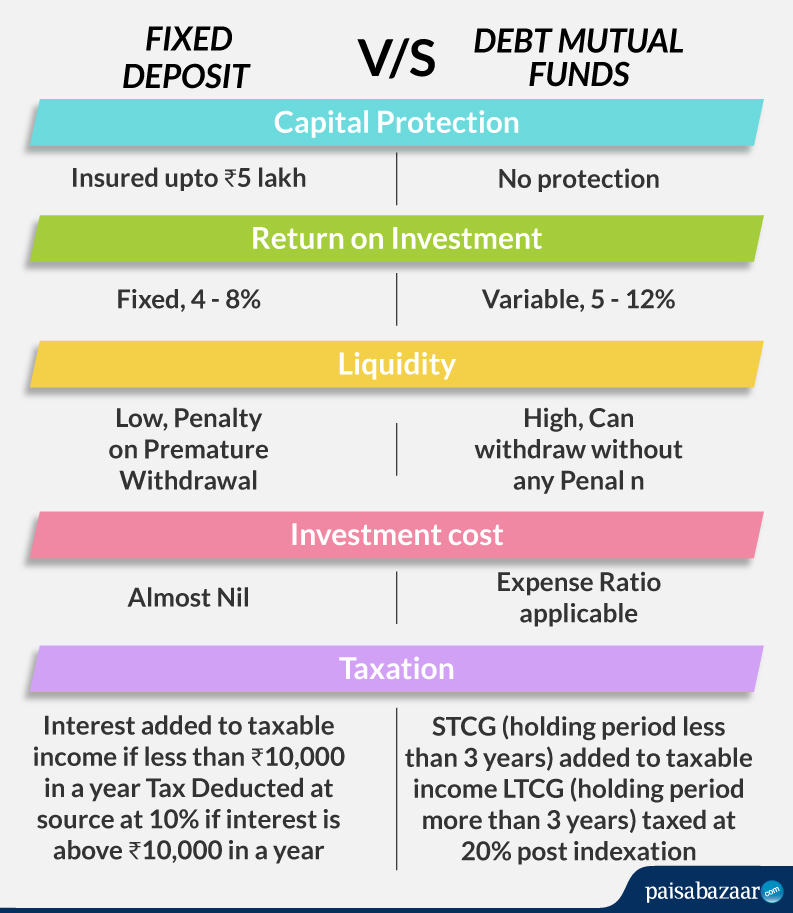

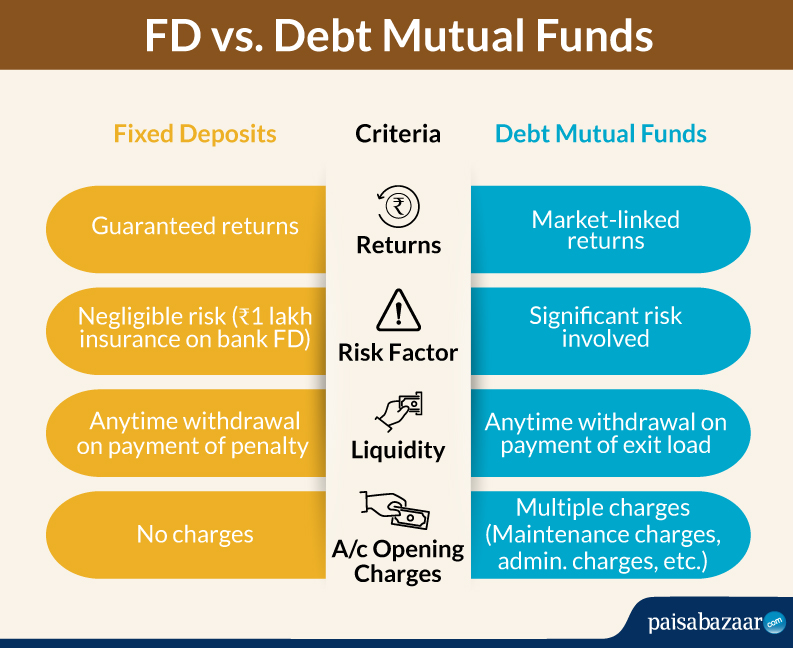

Debt Funds Vs Fixed Deposits Which is Better to Invest Paisabazaar

Fixed interest investment Investing, Investment advice, Investment portfolio

FD vs Debt Mutual Funds Which is Better?

Fixed interest funds fall sharply, and retirees suffer the most The Australian

Which Bank Has The Highest Interest Rate For Fixed Deposit In Malaysia Free Download Nude

Comparison of Mutual Funds with Other Investment Options

Fixed Deposit Interest Rates of Small Finance Banks Yadnya Investment Academy

Where should I invest? Mutual Funds or Fixed Deposits

Fixed Interest Rate 8.40 मंथली इनकम 19,178/ रु Best Fixed Deposit For Monthly

Commonwealth Bank CUTS Fixed Interest Rate By 1.2. Does This Ignite Housing Prices? YouTube

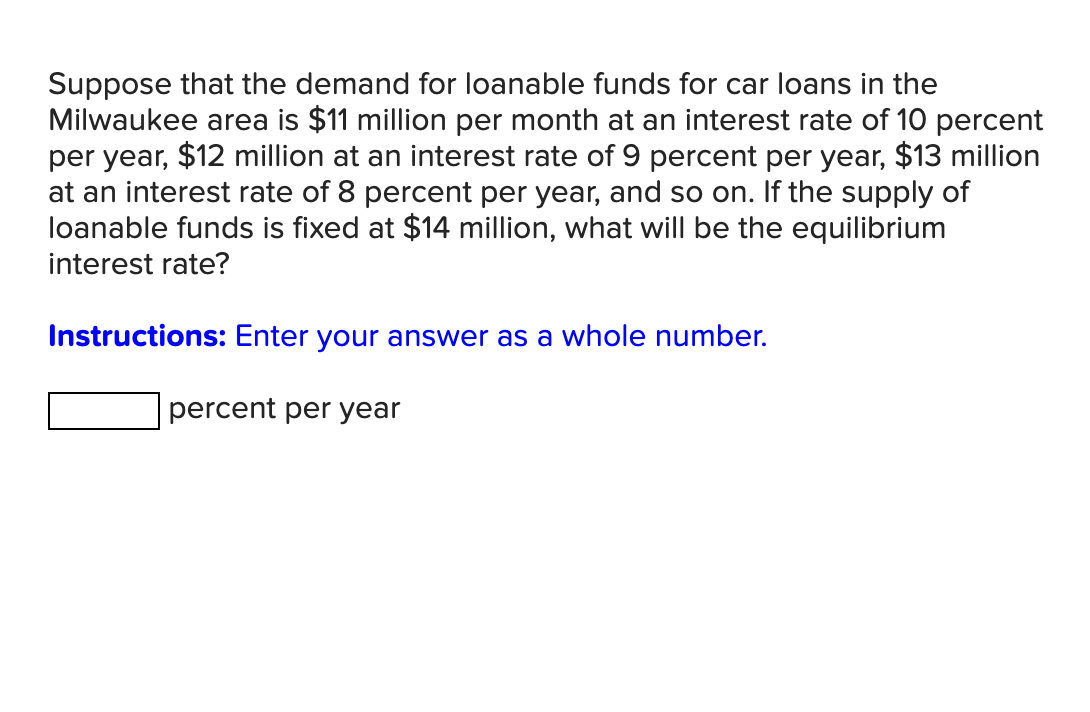

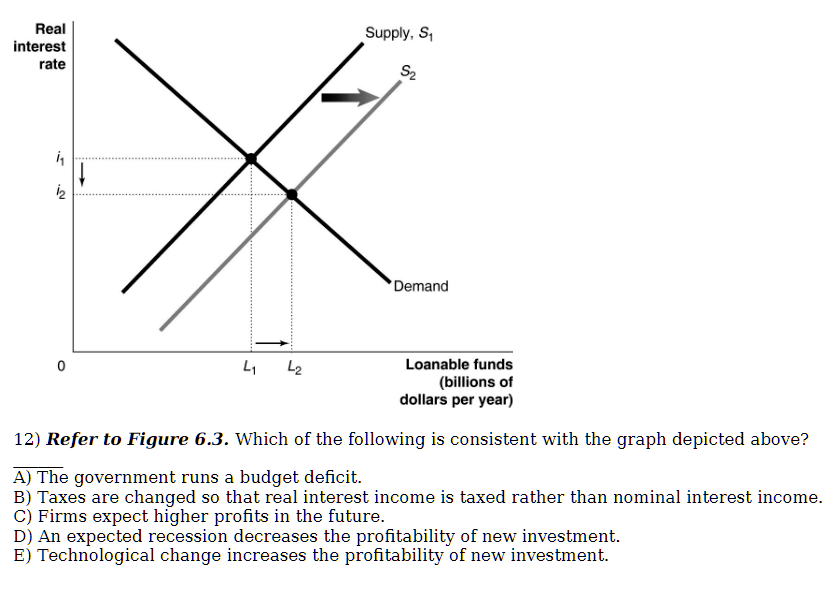

Solved Suppose that the demand for loanable funds for car

Home Loan Fixed vs Floating Interest Rate Financial Planner & Investment Advisor in India

Mutual Funds for Monthly Invest with Einvestment Fund

Fixed Deposit Interest Rates of Major Banks May 2020 Yadnya Investment Academy

How the investing industry tackles digital risks EBRAND

What Is a Variable Interest Rate?

Solved Real interest rate Supply, S Demand L1 L2 Loanable

How Does Inflation Affect FixedRate Loans? Team Financial Group

Infographic Fixed Deposits vs Mutual Funds Orowealth Blog

humbl loans

BlackRock’s Tax Evaluator tool tracks capital gain estimates for 7,000+ funds to help you get ahead of capital gains and build a more tax-efficient portfolio. Now that yields are back, it may be time to revisit fixed income. Move back into bonds and build portfolios based on your clients’ goals.. 1. Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX) Net Assets: $14.7 billion. Yield to Maturity: 4.3%. The Vanguard High-Yield Tax-Exempt Fund Investor Shares is a long-term municipal.